The Saga of Clarence Thomas and His Luxury RV Takes a Disturbing Turn

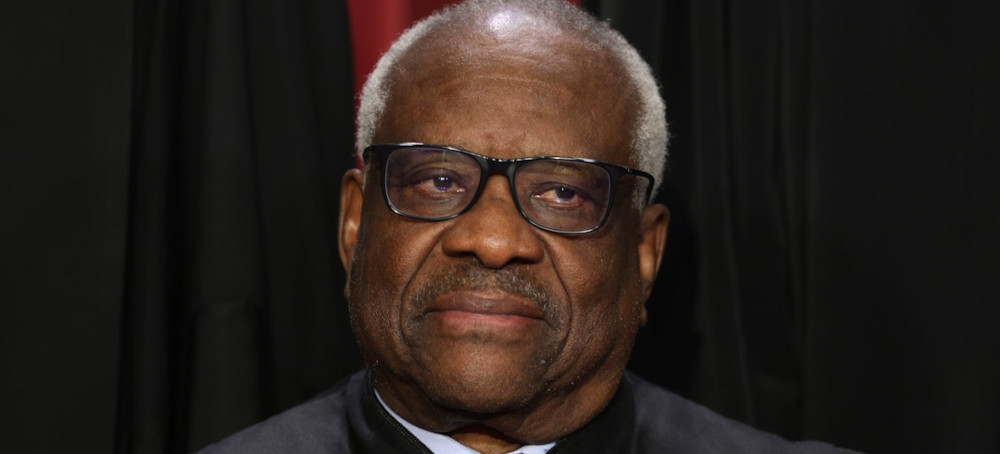

Greg Sargent The New Republic Supreme Court Associate Justice Clarence Thomas in Washington, D.C., on October 7, 2022. (photo: Getty)

Supreme Court Associate Justice Clarence Thomas in Washington, D.C., on October 7, 2022. (photo: Getty)

In a new letter, Democratic senators press the associate justice on whether he’s paid off the loan for that famous R.V.—and whether he may have ducked federal tax obligations.

So it’s fitting that the latest sordid turn in these sagas involves none other than Thomas’s recreational vehicle, that symbol of his yearning to escape Washington to mingle with reg’lar folk who don’t subject each other to the viciousness he faces in the capital.

Thomas is still refusing to reveal whether he repaid the principal on the $267,000 loan that he received from Anthony Welters, a wealthy health care executive and personal friend, to purchase his R.V. in 1999, according to a letter that Senators Ron Wyden and Sheldon Whitehouse have sent to an attorney for Thomas.

Thomas also has yet to say whether the loan’s principal was forgiven by the lender, the Democrats argue in the letter, which was obtained by The New Republic. If it was forgiven all or in part, the senators say, it could constitute “a significant amount of taxable income” that should be reported on federal tax returns.

“Your client’s refusal to clarify how the loan was resolved raises serious concerns regarding violations of federal tax laws,” the senators write. Wyden chairs the Finance Committee, and Whitehouse chairs the Judiciary Committee’s panel on federal courts, both of which are spearheading an investigation of Supreme Court ethics scandals.

The tale involving this R.V. constitutes one of the higher-profile instances of Thomas potentially accepting a form of income from wealthy benefactors, resulting in a drumbeat of stories that have shaken the court. Though Thomas’s frequent depiction of his Prevost Marathon R.V. (which he purchased used) as a sign of his affection for salt-of-the-earth leisure activities appears sincere, it’s also a luxury vehicle and an extremely pricey asset, perhaps comparable to a medium-size yacht.

The whole saga began when The New York Times revealed last summer that Thomas had purchased the R.V. in 1999 for $267,230 with financing from Welters that Thomas almost certainly could not have obtained from a bank, as experts told the Times.

In response to the paper’s questions, Welters—a longtime friend who grew up poor, as Thomas did, and went on to amass a reported $80 million fortune in the health care industry—would say only that the loan was “satisfied.” As the Times noted, this doesn’t mean the loan was paid back.

Thomas also has not been forthcoming, the Democrats say. Since the Times story broke, Wyden’s Finance Committee has sought information about the loan and, through Welters’s cooperation, has obtained a limited number of documents related to it. As the committee announced last fall, those materials showed only that Thomas had paid back some of the interest and appeared to reveal that, in 2008, Welters forgave most or all of the principal of the loan.

But Thomas did not report this on his 2008 Financial Disclosure Report, the committee said, and in response to the committee’s questions, he has not clarified whether he reported any of that money as income on tax filings.

Which brings us to the present. The senators have been pressing Thomas’s lawyer, Elliot Berke, to provide additional detail on the forgiven loan, and last month, Berke responded with a letter. But once again, the letter—which TNR viewed—offered little additional clarity. It said Thomas “made all payments” on a “regular basis until the terms of the agreement were satisfied in full” and that he’s complied with judicial disclosure requirements.

That avoids detailing what those terms were, whether the payments were merely for interest—as opposed to paying off the loan’s principal—and whether the arrangement ended up forgiving much or all of that principal. If so, it would functionally constitute a large chunk of taxable income, Wyden argued.

“This raises the question of whether this justice is in compliance with federal tax law, which requires a disclosure of forgiven debt and taxable income,” Wyden told me. “The central question is: Did he ever repay the principal?”

The senators’ new letter demands more information on all those fronts. Berke, Thomas’s lawyer, didn’t respond to a request for comment.

This raises important issues even if there is no suggestion whatsoever that this particular money impacted any Thomas rulings or that Welters himself had any business before the court. We should expect such transparency from judges because we deserve to know what sort of financial interests could conceivably motivate those who issue rulings that shape our lives, and because judges should serve as models of upholding rules and laws upon which the integrity of the system rests, notes Stephen Vladeck, a law professor at the University of Texas at Austin.

“We subject all federal judges—including the justices—to financial disclosure rules because we are worried about even the appearance that they are deciding cases in ways that are consistent with their financial interests,” Vladeck said, stressing that the Democrats are raising legitimate questions about Thomas.

“We want judges and justices who are participating in the system and not subverting it,” Vladeck added, and thus “lead by example.”

After ProPublica revealed that Thomas accepted an extraordinary array of luxury trips and vacations from billionaire and Republican megadonor Harlan Crow without disclosing them, Thomas defended his conduct. He claimed that “colleagues” advised him that “hospitality from close personal friends” is “not reportable,” but ethics experts sharply dispute this and insist such disclosure is required.

That aside, as The New Republic’s Matt Ford argues, Thomas has made it clear he views all this mainly as a public relations problem and demonstrates little concern for any need to demonstrate ethical propriety, thus making him partly responsible for the questions and the “nastiness” that continue to dog him.

Wyden seconds the point. Thomas could simply be more forthcoming about the R.V. loan, he says, thus demonstrating both that he respects the need to maintain appearances and that he’s in compliance with income tax filing requirements.

“We’re giving the justice the opportunity to clear this huge mess up,” Wyden told me. “Nobody in this country is above the law. Not even Supreme Court justices.”