The Kleptocrats Aren’t Just Stealing Money. They’re Stealing Democracy

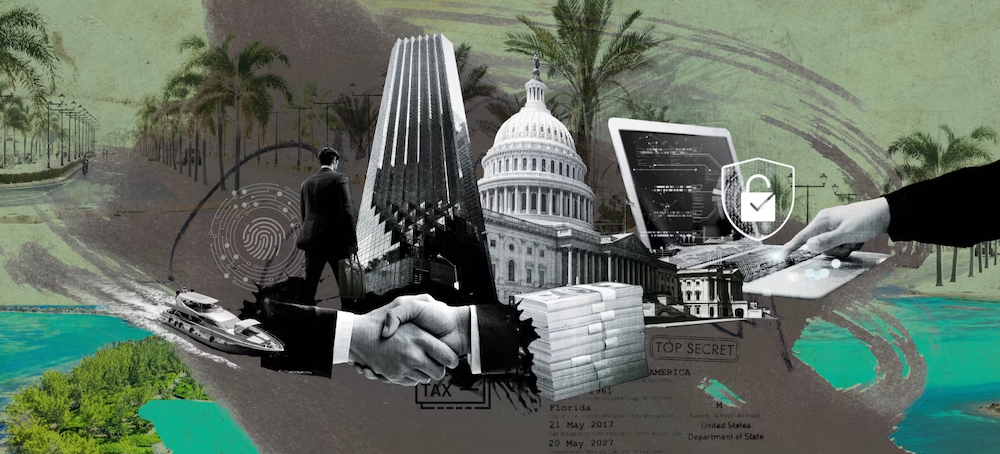

Anne Applebaum Financial Times "The confiscation of a few yachts is no solution." (photo: FT)

"The confiscation of a few yachts is no solution." (photo: FT) The Kleptocrats Aren’t Just Stealing Money. They’re Stealing Democracy

Anne Applebaum Financial Times

A shadow world of secret wealth now threatens us all. We need to shut it down, argues Anne Applebaum

Not that this was anything exceptional: in the four decades that followed, more than a fifth of the sales in Trump-owned and Trump-licensed buildings, more than 1,300 properties, were made to anonymously owned shell companies, for cash, without a mortgage, which meant the purchasers did not have to have any uncomfortable conversations with lenders.

Some of those companies sold those condos again, very quickly, at much higher prices or at much lower prices — usually a sign that money laundering might have been the actual purpose of the purchase. A Trump-licensed building in Florida sold a two-bedroom condo to a shell company on August 12 2010, for example, for $956,768. That shell company sold the condo to another shell company, at a heavy loss, for $525,000 that same day.

All of these transactions were legal and there’s no evidence to suggest that Trump or his companies knew of or were complicit in money laundering schemes. They have been reported and described many times. The examples cited above come from a BuzzFeed investigation published six years ago, in 2018, but it wasn’t the only one. A Financial Times investigation in that same year also found that Russian, Kazakh and other post-Soviet oligarchs had probably been laundering money through Trump-licensed properties.

During Trump’s presidency, the scrutiny on his business dealings intensified, but that made no difference: the proportion of his company’s anonymous sales went up, not down. In 2017, the first year of the Trump administration, more than two-thirds of sales in Trump-owned or Trump-licensed buildings, tens of millions of dollars’ worth of property, went to anonymous purchasers. If any of the buyers were hoping thereby to influence the domestic or foreign policy decisions of the Trump administration, we will never know.

In the years since Trump’s 2016 election, a lot has been written about his autocratic instincts, about his scorn for ethical norms and about his attempt to retain power after losing the 2020 election. But as illustrated by the story of his real estate company’s reliance on dubious shell companies, Trump was already operating in an alternate ethical universe long before he became president, a world where the rules that most ordinary people live by are easily broken.

Inside this domain, anonymously owned companies and funds based in offshore tax havens hide what could be as much as 10 per cent of the world’s GDP. This is money earned from organised crime or narcotics operations, stolen from legitimate institutions, or simply hidden, legally, with the aim of avoiding taxation, alimony or embarrassment. In this world, theft is rewarded. Taxes are not paid. Law enforcement is impotent and underfunded. Regulation is something to be dodged, not respected. The climate of this alternate reality is so different from the ordinary world that many have sought to find a name for it. The journalist Oliver Bullough called it “Moneyland”, the title of the book he published in 2018. Tom Burgis, then an FT reporter, named it “Kleptopia” in his book of 2020.

Until recently, this alternative universe was considered a kind of nuisance, perhaps a problem for chronically underfunded regulators but not really something that required more political attention. However, since Russia’s full-scale invasion of Ukraine in 2022, more people have begun to understand the ways in which the secret economy now poses a genuine national security threat to the US, to the UK, to Europe and to other democracies.

More to the point, they understand that the confiscation of a few yachts is no solution. What if, instead, we shut it all down? Whatever small advantages secrecy provides to some, businesses cannot compensate for the lethal threat that secretive business practices pose to democracy itself. The banks, financial institutions, law firms and accountants who constructed the opaque world of money laundering and tax havens could now deconstruct it.

Kleptocracy, in its modern form, began in the 1990s. Multiple accounts of Vladimir Putin’s rise to power have shown, for example, how even as deputy mayor of St Petersburg at that time he presided over schemes to steal money from the state, to launder it abroad and then bring it back into Russia, all with the help of European partners. Although Putin has spent his life as a civil servant, he has used his stolen money, and the stolen money hoarded by his inner circle, as a source of power and influence ever since.

Since the 1990s, the kleptocratic model created in Russia has spread much further. From Angola to Zimbabwe, dictators with access to hidden sources of wealth are better able to resist demands for political change. They can hide their families and their property abroad. They can finance bribery and influence operations. The aura of secrecy they build is also part of what keeps them in power. Ordinary Russians, ordinary Chinese or ordinary Venezuelans are not allowed to know why their rulers, and their rulers’ friends and their families, are billionaires, because they’re not meant to have any influence or understanding or knowledge of politics at all. That lack of knowledge creates a sense of helplessness, apathy, even despair.

The rise of kleptocratic autocracies has affected the democratic world too, shaping it in unseen ways. That we don’t know whether any Americans or any foreigners sought to influence the Trump administration using the president’s condo sales is only the beginning of the problem. The very architecture of our cities — London, Miami, New York — has been shaped by people who purchase houses as a secret store of value, who don’t necessarily intend to live in them at all.

This isn’t supposed to help criminals: most EU countries already have anti-money-laundering laws for real estate, for example. But they don’t have the apparatus to enforce them. Meanwhile, in some countries, the US included, the same financial instruments that allow people to hide wealth from tax authorities also allow them to donate anonymously to political campaigns, or to affect politics indirectly, through influence or personal contacts.

Both the lack of transparency and the law’s helplessness create apathy and cynicism about our political systems, just as they do in the autocratic world — a cynicism that can feed into extremism and support for anti-democratic parties and ideas.

Sheldon Whitehouse, a US senator who has lobbied hard to end anonymous transactions and curb the role of dark money in US politics, puts it like this: “Secrecy and democracy are antithetical,” he told me. “If American citizens aren’t allowed to understand who’s who on the political playing field, who’s playing for what team, who they really are, who they’re representing, you have disabled perhaps the most fundamental foundation of democracy.”

Perhaps the oddest thing about this system is the complacency it engenders. At least until recently, offshore tax havens were often treated like natural phenomena, land formations that cannot be changed or moved. The laws that made US states such as Delaware or South Dakota havens for people who wanted to hide money in trusts or anonymous companies were shrugged away as local problems. But all of these things are creations of the legal system, and they can easily be made illegal too.

We could, for example, require all real estate transactions, everywhere in the US and Europe, to be totally transparent. We could require all companies to be registered in the name of their true owners, or all trusts to reveal the names of their beneficiaries. We could ban our own citizens from keeping money in jurisdictions that promote secrecy, and we could ban lawyers and accountants from engaging with them. That doesn’t mean that they would cease to exist, but they would be much harder to use. We could close loopholes that allow anonymity in the private equity and hedge fund industries. We could create effective enforcement teams and then help them to operate across countries and continents.

We could do all of this in co-ordination with other partners around the world, and we could do so firm in the conviction that transparency is the normal, standard way of conducting business. Gary Kalman, the executive director of the US branch of Transparency International, the anti-corruption NGO, points out that the “vast majority of small business owners don’t have a problem naming their company — in fact, they often name the company after themselves.”

In recent years, both Britain and the US have made progress in this direction. David Cameron, then UK prime minister, held an anti-corruption summit back in 2016. The Biden administration began to treat kleptocracy and grand corruption as matters for the National Security Council, not just for the Treasury. In 2024’s UK general election, Keir Starmer and foreign secretary David Lammy explicitly campaigned around the fight against kleptocracy, including in British Overseas Territories. More than 110 countries have pledged, in theory, to collect the names and basic information about the beneficial owners of companies and property.

This slow shift of emphasis has had some results. Until last year, it was still possible to set up a company in Britain directly through Companies House, without providing any identifying information. Now minimal identification, of the kind anyone would need to apply for a bank account, passport or driving licence, is being introduced. There are still some ways around this, through the use of company formation agents which may be less stringent in checking identification, for example. Some legitimate exceptions can be made to the publication of information, for instance in the case of public figures who might be stalked. But the change is real.

As of this year, the US also now requires most companies to file a very short, one-page document, containing the name, address, date of birth and driver’s licence, passport or government identity number of the beneficial owner. As of August 28, the US Treasury has also extended anti-corruption and anti-money laundering requirements to residential real estate professionals as well as investment advisers working in the private investment market.

Still, none of these measures solves the whole problem. EU privacy laws have been used as an excuse to stop progress. Lawsuits in the US have been launched in an attempt to block even minimal disclosure requirements. Tax havens, among them British Overseas Territories, have resisted pressure to bring in similar rules.

More to the point, a handful of laws may not be sufficient. Powerful, wealthy people — the leaders of legitimate, prominent businesses, sometimes backed by chambers of commerce or liberal newspapers — will no doubt continue to seek to block transparency. The regulators assigned to monitor these legal changes could be deprived of funding. Although a set of corporate transparency measures did pass during his administration, President Trump was not especially interested in the enforcement of anti-corruption laws, even reportedly telling then secretary of state Rex Tillerson, in the spring of 2017, to “get rid of” the Foreign Corrupt Practices Act, which bars American companies from bribing foreign officials. Although he failed to eliminate that law entirely, he did slow down investigations and prosecutions, and could, of course, do so again.

The secretive world of kleptocracy is also protected by its own complexity. Money-laundering mechanisms are hard to understand and even harder to police. Anonymous transactions can move through different bank accounts in different countries in a matter of seconds, while anyone seeking to follow the money may need years to pursue the same trail. Civil servants charged with tracking complex, secretive billion-dollar deals earn low salaries themselves, and may not want to tangle with people of much greater wealth and influence.

For all those reasons, it’s clear that no single politician, party or country can do this alone. Instead, an international coalition, led by the wealthiest countries but with broader participation, is required to change the laws, end secretive practices and restore transparency to the international financial system. The democratic world has successfully created a network to block the financing of terrorism. Similarly, an anti-kleptocracy network could also include those treasury and finance ministry officials from across Europe, Asia and North America who have begun to understand how much damage money laundering and dark money have done to their own economies. They could work with community leaders from London, Vancouver, Miami and other cities whose landscapes, property markets and economies have been distorted by kleptocrats buying property that they use as a means of storing wealth.

The coalition could also include the activists who know more about how money is stolen in their own countries than outsiders, and more about how to communicate that information. Alexei Navalny, who was so good at both, died in a Russian prison. Before his arrest, Navalny made a series of crowdfunded documentary films, posted on YouTube, that tied the leaders of Russia to far-reaching financial scams and broad networks of enablers.

The videos succeeded because they were professionally made, because they included shocking details — the hookah lounge and hockey rink inside Putin’s vulgar Black Sea residence, as well as the vineyard, the helicopter pad and the oyster farm — and because they linked these stories to the poverty of Russian teachers, doctors and civil servants. You have bad roads and bad healthcare, Navalny told Russians, because they have vineyards, helicopter pads and oyster farms.

This was investigative journalism but packaged and designed to move people — to explain to them the connection between the palaces built by distant rulers and their own damaged lives — and it worked. Some of the videos received hundreds of millions of views.

Now imagine the same project, but backed by democratic governments, media and activists around the world. Not just investigations, and not just prosecutions, but a campaign to publicise them, and to connect them to ordinary people’s lives. Just as the democratic world once built an international anti-communist alliance, so can the US and its allies build an international anti-corruption alliance, organised around the idea of transparency, accountability and fairness. This isn’t just a nice-sounding idea: it may be necessary for the preservation of liberal democracy, in the form that we know it.